I had the pleasure of attending a networking event of Americas Apparel Producers’ Network – AAPN a few weeks ago. The presentation topics and discussions ranged from lighter reminiscences of past gatherings to hard core statistics around today’s retail.

As a take-away I thought a grim view was painted of the main stream apparel value chain of brand owners and retailers. This traditional apparel retail value chain seems slow and rigid; and is definitely challenged by online sales and vertically integrated fast fashion companies.

Recently I’ve also heard presentations from a couple of vertically integrated retail chains – with focus on their RAIN RFID projects. Those stories painted a more positive view of the retail value chain.

Read on to see how these two opposite forecasts might merge.

Slow Moving and Heavy Inventory Make Department Stores Suffer

The key issue is summed up in a few bullet points:

- Traditional value chain takes an average of 9 months to get from a product idea to sales.

- Because of slow processes the chain must rely on heavy stocking of manufactured goods.

- Because of large stocks, a large portion of products are still unsold when fashion changes. Items are sold with high average discounts.

- Add the fixed cost of retail stores and problems arise.

Announced department store closures were provided as an evidence:

- Macy’s closes 68 stores – January 2017

- JC Penney closes up to 140 stores – February 2017

- Sears closes 150 stores – January 2017

Online and Fast Fashion Thrives

On-line stores can sell with the same cost of goods sold and pricing structure, but with lower fixed costs. Bottom line is still positive. Fast fashion chains can maintain lower stock levels and follow fast trends more quickly. There is less need to high discounts and margins are enough to cover fixed costs. There is profit to invest.

- Inditex will open hundreds of new stores

- H&M opened 427 stores in 2016, although plans to cut down opening amount in 2017

Root Cause Is the Traditional Management Focus on Costs

An analysis is presented in Apparel News article.

- In the traditional model the link between retailer and brand owner is broken.

- Retailers focus on cost. It is the only item they can fully control and they fully understand. And apparel manufacturers must follow with cost focus. There are no resources to improve processes or focus on the yarn types and fabric qualities. It is hard to break this malicious cycle.

Information Sharing Should Become The New Focus

RAIN RFID is a technology that can create a vast amount of data, and turn that data into meaningful information. When this information is produced at the retailer and shared with brand owner, the value chain can be improved.

Decathlon case study by Tageos

Inditex presentation

There are plenty of case studies like the ones above. But let’s look some use cases beyond the case studies – how RAIN RFID can be used in shortening the cycle times.

Faster Everything Means More Efficient Everything

With RAIN RFID tagged store merchandise, replenishment needs at the shop floor are noticed in real time, and the information can be shared real time with warehouse, distribution and factory. When the rules are set, just rely on EDI and automation to keep the stores running. Every party in the supply chain knows how much stock there is at various upstream locations, and when is their time to react.

The key enabler is the accurate and real time inventory – the key deliverable of RAIN RFID. When the process works, the initial stock levels can be lower across the value chain, and there’s your Cost Saving right there.

Instant Feedback from Store to Design Accelerates Season Cycles

As the merchandise is RAIN tagged due to the efficiency reasons stated above, smart fitting rooms, info kiosks and store associates can be utilized to collect information about consumer preferences. Real-time pre-purchase information about models, sizes, and colors that are interesting to customers can be used to optimize store layouts, but especially valuable it is to the brand owners.

Such insight enables the designer to assume a new kind of ownership of the product. Minor fixes can even be implemented during a season. This real-time collaboration through the value chain rises the clock rate of traditional brick and mortar stores to match and exceed the vertically intergrated ones.

What Should Apparel Manufacturers Do?

Instead of following the lead of retailers, the brand owners should assume a more active role. Here’s a couple of pointers:

- Learn the basics of RAIN RFID – consider a webinar, attend a 101 course or follow the RAIN Alliance.

- Take a look at what your fellow competitors are doing: The Herman Kay case study by GS1 sets a great example, and here’s another story referencing lululemon and Adidas

- Instead of being compliant, manufacturers should check that requirements take into account also manufacturers’ own needs – manufacturers should especially demand the requirements in a format that enables them to scale and optimize, such as the GS1 TIPP grades.

What Has Voyantic to Do with All of This?

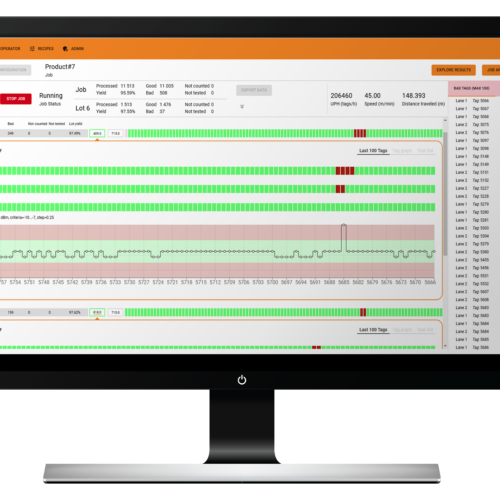

Voyantic offers RAIN RFID testing solutions and systems. Our performance testing equipment enables anyone to implement RAIN RFID tagging according retailer’s and manufacturer’s requirements. Our solutions ensure quality monitoring across the whole tagging process. We are happy to provide more information of RFID – start from our webinars, for example!

All blog posts